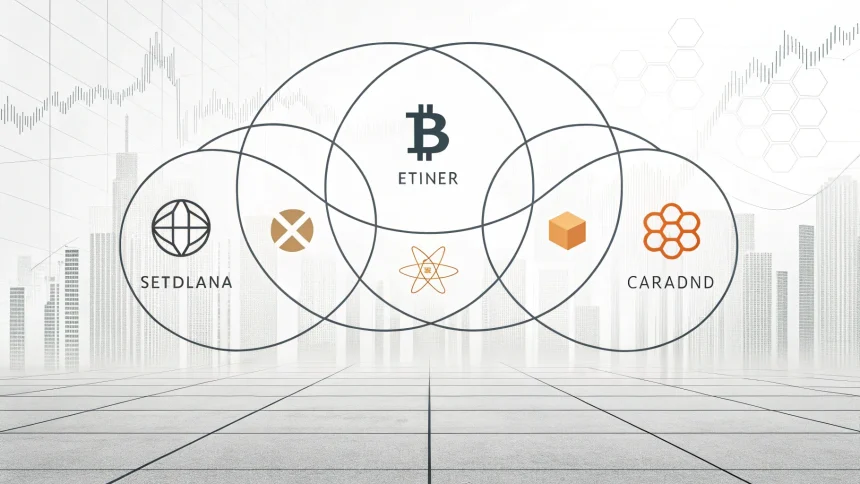

Grayscale, in collaboration with CoinDesk Indices, introduced a new exchange-traded fund that packages five major digital assets into a single product, aiming to simplify diversified crypto exposure for investors. The fund, called the Grayscale CoinDesk Crypto 5 ETF, includes bitcoin, ether, XRP, Solana, and Cardano, according to company materials. It arrives as interest in crypto funds remains high and investors look for broader exposure without managing multiple coins.

The companies say the fund groups the market’s largest and most liquid tokens. The approach mirrors how broad equity ETFs track baskets of leading stocks. It could appeal to investors who want sector-wide exposure while limiting single-asset bets.

“The Grayscale CoinDesk Crypto 5 ETF bundles together the five largest and most liquid digital assets — bitcoin, ether, XRP, Solana, and Cardano.”

Why This Matters Now

The move comes after a year of rapid growth for crypto-linked funds. Spot bitcoin ETFs launched in the United States in early 2024 and gathered strong inflows. Ether funds followed later in the year, showing continued appetite for regulated, exchange-traded access to digital assets. A basket approach could be the next step for investors seeking wider coverage in one trade.

Grayscale is one of the best-known issuers in the space, having converted its flagship bitcoin trust into an ETF. CoinDesk Indices supplies benchmarks such as the CoinDesk 20, used by asset managers and trading firms to track market segments. Their partnership signals an attempt to formalize how diversified crypto exposure could look in a fund format.

What the Basket Includes

The product focuses on five tokens that dominate trading volumes and market value. Bitcoin and ether anchor the market and often set price direction. XRP, Solana, and Cardano round out the group as established networks with active communities and deep liquidity relative to most altcoins.

- Bitcoin (BTC): the largest digital asset by market value.

- Ether (ETH): the token powering the Ethereum network.

- XRP: a payments-focused token used on the XRP Ledger.

- Solana (SOL): known for high throughput and low fees.

- Cardano (ADA): a proof-of-stake network with a focus on research-driven development.

Details such as weights, rebalancing, fees, and custody arrangements will shape how closely the fund reflects market moves and how it manages concentration risk. Investors will watch for disclosures on index rules and whether the fund uses spot holdings, futures, or a mix, depending on jurisdiction and approvals.

Regulatory and Legal Considerations

Rules for crypto funds vary by market. In the U.S., spot bitcoin and ether ETFs are trading, but multi-asset spot products face added review. Outside the U.S., exchange-traded products that hold baskets of crypto are more common. Where and how the Crypto 5 ETF lists will influence investor access and daily liquidity.

Legal status remains a factor for some tokens. U.S. regulators have questioned whether certain assets, including Solana and Cardano, meet securities tests, while XRP’s status has been shaped by ongoing litigation and partial court rulings. Issuers typically address these issues through index design, disclosures, and custody practices to align with local rules.

Investor Use Cases and Risks

A single-ticket basket can reduce the time and cost of building coverage across multiple coins. It may also lower the impact of a sharp move in any one asset. However, crypto markets are highly volatile, and these five tokens remain closely correlated in stress periods, which can limit diversification benefits.

Key risks include regulatory changes, market liquidity during sell-offs, custody security, and tracking error if the fund uses derivatives or strict rebalancing bands. Fee levels will also matter, as investors compare costs with holding single-asset ETFs or tokens directly on exchanges.

What to Watch Next

The next milestones include formal filings, listing venue, expense ratio, and the underlying index methodology from CoinDesk Indices. Market reaction will show whether investors prefer a basket or keep favoring single-asset funds for tactical positioning.

If adopted, the Crypto 5 ETF could become a reference product for general crypto exposure in brokerage and retirement accounts, much like broad market stock ETFs. If not, it may still push issuers to refine rules-based baskets and improve disclosure on liquidity and risk.

For now, the launch signals sustained demand for simpler, regulated access to multiple digital assets. Investors should review the fund’s documents closely, compare fees and structure with alternatives, and watch how the product trades in its first months.