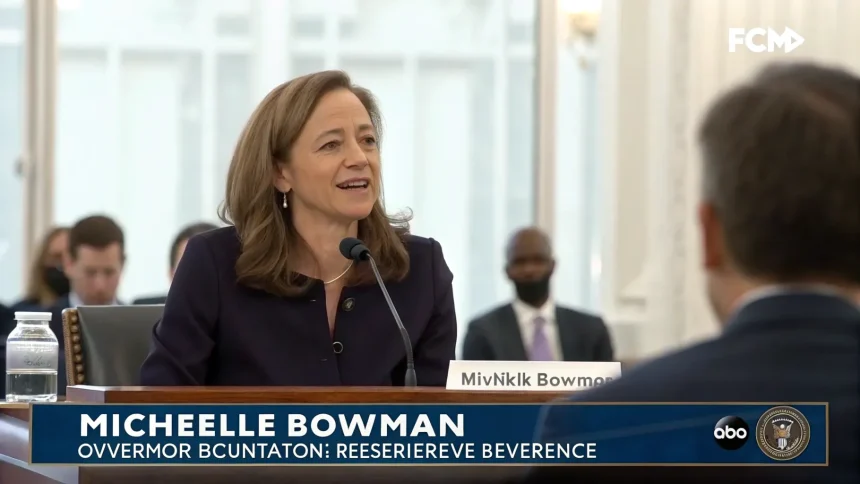

Federal Reserve Governor Michelle Bowman defended the central bank’s independence in a televised interview, as political heat rises over interest rate decisions that affect households and markets. Speaking ahead of a day-long conference on bank regulation she is hosting at the Federal Reserve, Bowman said the Fed must act without political interference even as former President Donald Trump steps up criticism of Chair Jerome Powell for not cutting rates.

Bowman, who was appointed to the Fed’s Board of Governors by Trump, stressed that policy should be set by economic data, not political wishes. Her remarks arrive during a tense period in which rate policy, inflation progress, and election-year rhetoric are colliding.

Fed Independence Reaffirmed

Bowman’s central message centered on the principle that has guided the Fed for decades: keep political pressure at arm’s length to safeguard price stability and employment. She said maintaining that distance protects the Fed’s credibility and helps anchor public expectations.

“It’s very important … that we maintain our independence with respect to monetary policy,” Bowman said.

That stance aligns with prior statements from Powell and other officials who have routinely argued that the Fed’s decisions must be driven by data and the mandate set by Congress. The Fed was designed to be insulated from day-to-day politics to prevent short-term impulses from causing long-term harm.

Political Pressure Intensifies

Trump has criticized the central bank and Powell for not lowering rates as he would prefer. Those attacks mirror past episodes in U.S. history when presidents pressed the Fed during high-stakes economic moments. While elected leaders often speak out, the Fed’s structure—long terms for governors, and policy set by the Federal Open Market Committee—helps buffer policy from shifting political winds.

Bowman’s comments arrive as rate policy debates grow louder. Inflation has cooled from earlier peaks, but officials remain cautious about declaring victory. Cutting too soon risks renewed price pressures. Holding rates high for too long could slow growth more than intended. That trade-off is at the center of today’s dispute.

Why Independence Matters

The Fed’s track record shows the costs of bending to political pressure. Economists often point to past cycles where late or rushed moves added to inflation or produced sharper downturns. Independence seeks to reduce those risks by tying decisions to a steady process and outlook, not short-term gains.

Bowman’s reminder comes as financial markets try to read Fed signals while parsing campaign statements. Investors want clarity on the path of rates, yet the Fed’s message has been consistent: decisions will follow incoming data, labor market conditions, and inflation trends.

- Cutting rates too quickly could reheat prices and unsettle expectations.

- Holding steady allows more time to judge whether inflation is easing in a lasting way.

- Policy signals are meant to guide markets while avoiding sudden shocks.

Bank Regulation in the Spotlight

Bowman spoke before a conference focused on bank oversight, an area where tensions also run high after recent regional bank failures. Regulators have weighed tougher standards on liquidity, interest rate risk, and capital. Industry groups warn that higher requirements could curb lending or raise costs for borrowers. Advocates argue that stronger buffers reduce the odds of taxpayer-funded rescues and protect depositors.

Her role at the event suggests a continued effort to gather views from supervisors, bankers, and academics as officials assess what worked and what did not during stress episodes. While rate policy grabs headlines, the safety and soundness of banks remains a key pillar of financial stability.

What Comes Next

The immediate question is whether inflation continues to cool enough to justify rate cuts. If price gains slow and the labor market stays steady, the case for lower rates grows. If inflation stalls or reaccelerates, holding the line—or even tighter policy—could stay on the table. That has political ramifications, yet the Fed’s stated plan is to follow the numbers, not the noise.

Bowman’s comments signal that the central bank is preparing to make difficult calls in a heated environment. The takeaway for households and businesses is straightforward: watch the data, watch the Fed’s projections, and expect policy moves to be methodical rather than reactive to political pressure.

As campaign rhetoric intensifies, the Fed’s credibility will be tested. Bowman’s defense of independence sets a clear marker: monetary policy will be guided by evidence and the central bank’s mandate. The focus now turns to the next set of inflation and employment reports, which will shape the path ahead for rates, markets, and the broader economy.