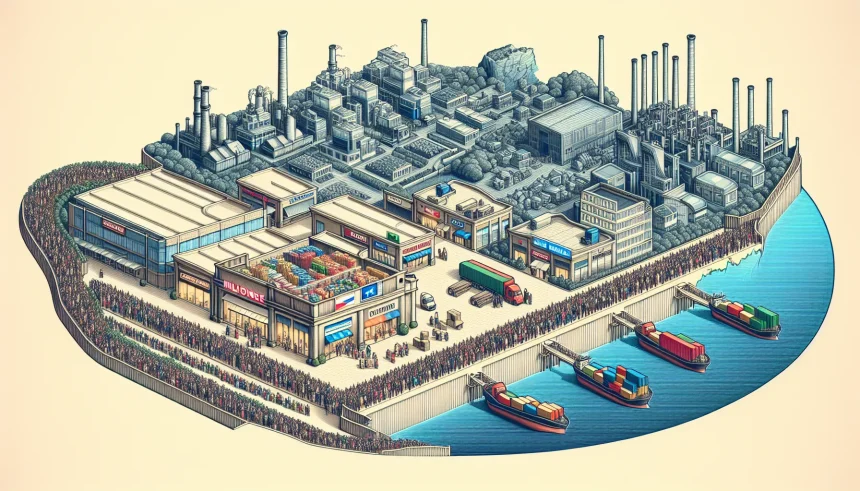

A looming Supreme Court fight over presidential tariff powers is drawing fresh attention from retailers and manufacturers. American Giant CEO Bayard Winthrop, speaking on a business morning program, outlined how a ruling tied to policies backed by former President Donald Trump could ripple through pricing, jobs, and sourcing decisions. He also discussed his company’s partnership with Walmart as a hedge against supply shocks and rising import costs.

The case lands at a moment of fragile consumer demand and persistent cost pressure. Retailers, from apparel to home goods, are weighing how much of any tariff to absorb and how much to pass to shoppers. The outcome could shape shelf prices ahead of key shopping periods.

What the Court could decide

At stake is the scope of executive authority to set and adjust tariffs. Past actions relied on laws that grant broad discretion to respond to trade imbalances, national security concerns, or unfair practices. A decision could reaffirm that reach or tighten it, changing how quickly future tariffs can be imposed or lifted.

Supporters of broad tariff tools say they protect strategic industries and jobs. Critics warn that sudden duties act as a tax on consumers and inject uncertainty into supply chains.

“Prices start at the border.”

That simple idea frames the commercial reality. Import costs roll through freight, warehousing, and retail margins, and often show up at the register.

Retail exposure: price tags, planning, and jobs

Retailers live on slim margins, especially in apparel and basics. A swing of even a few percentage points in duties can push companies to rework product mixes, delay launches, or trim features to hit target prices. Smaller brands tend to have less room to negotiate with suppliers or swallow costs.

Executives say the hardest part is planning. Buyers place orders months in advance. A policy shift mid-season can trap inventory at the wrong price. That can lead to markdowns, which protect shoppers in the short term but strain finances and payrolls.

- Higher tariffs often pass through to prices over time.

- Smaller firms have less leverage to offset increases.

- Uncertainty raises the risk of overstock and markdowns.

American sourcing as shock absorber

Winthrop highlighted domestic manufacturing as one path to reduce exposure. American Giant has long invested in U.S.-based factories and suppliers to stabilize lead times and maintain quality. Those networks can help when overseas costs climb, though they also face higher labor and compliance expenses.

Walmart’s public pledge to spend an additional $350 billion on products made, grown, or assembled in the United States by 2030 has encouraged suppliers to expand stateside capacity. For brands like American Giant, that demand signal can justify equipment upgrades and training programs, which may steady prices over time.

Retailers also see a marketing edge. Products labeled “Made in USA” can command customer loyalty, which supports stable pricing even when global trade frays.

Consumers and the checkout effect

Academic studies have found that many tariffs on consumer goods flow through to higher retail prices, adding hundreds of dollars a year to the typical household’s costs. The effect varies by category. Apparel, footwear, and certain home goods often show faster pass-through because alternatives are limited and volumes are large.

Still, some companies absorb part of the increase to protect market share. That can mean fewer new styles, lower fabric weights, or smaller assortments. The trade-off keeps prices in check while narrowing choices.

What to watch next

The legal calendar will guide how quickly retailers must move. If the Court sets strict limits on unilateral tariff actions, companies may see steadier rules and more lead time. If it affirms wide discretion, executives will likely expand contingency plans, split sourcing across regions, and lean harder on domestic partners.

For shoppers, the signals will show up in timing and breadth of promotions, not just sticker prices. More early-season discounts can hint at inventory mismatches driven by policy uncertainty.

Winthrop’s message was clear: the policy decision is not abstract. It shapes factory orders, hiring, and the final price of a hoodie or pair of socks. Domestic ties—such as Walmart’s U.S. sourcing push—offer a partial buffer, but they require steady demand and long-term investment.

The takeaway for the retail sector is practical. Prepare for either outcome by diversifying suppliers, building closer links with U.S. makers where possible, and communicating price changes with customers. The Court’s ruling will set the tone. Retailers will set the bill.